UNDER ARMOUR REPORTS FIRST QUARTER 2019 RESULTS

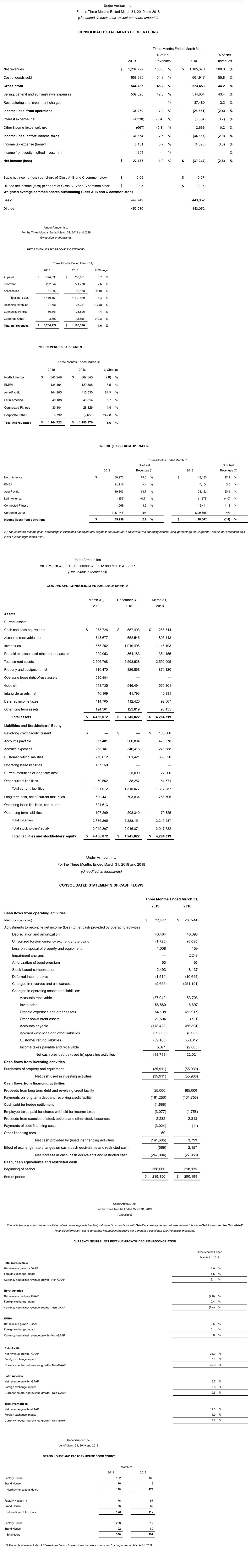

Under Armour, Inc. (NYSE: UA, UAA) today announced financial results for the first quarter ended March 31, 2019. The company reports its financial performance in accordance with accounting principles generally accepted in the United States of America ("GAAP”). This press release refers to “currency neutral” and “adjusted” amounts, which are non-GAAP financial measures described below under the “Non-GAAP Financial Information” paragraph. References to adjusted financial measures exclude the impact of the company’s 2018 restructuring plan and the related tax effects. Reconciliations of non-GAAP amounts to the most directly comparable financial measure calculated in accordance with GAAP are presented in supplemental financial information furnished with this release. All per share amounts are reported on a diluted basis.

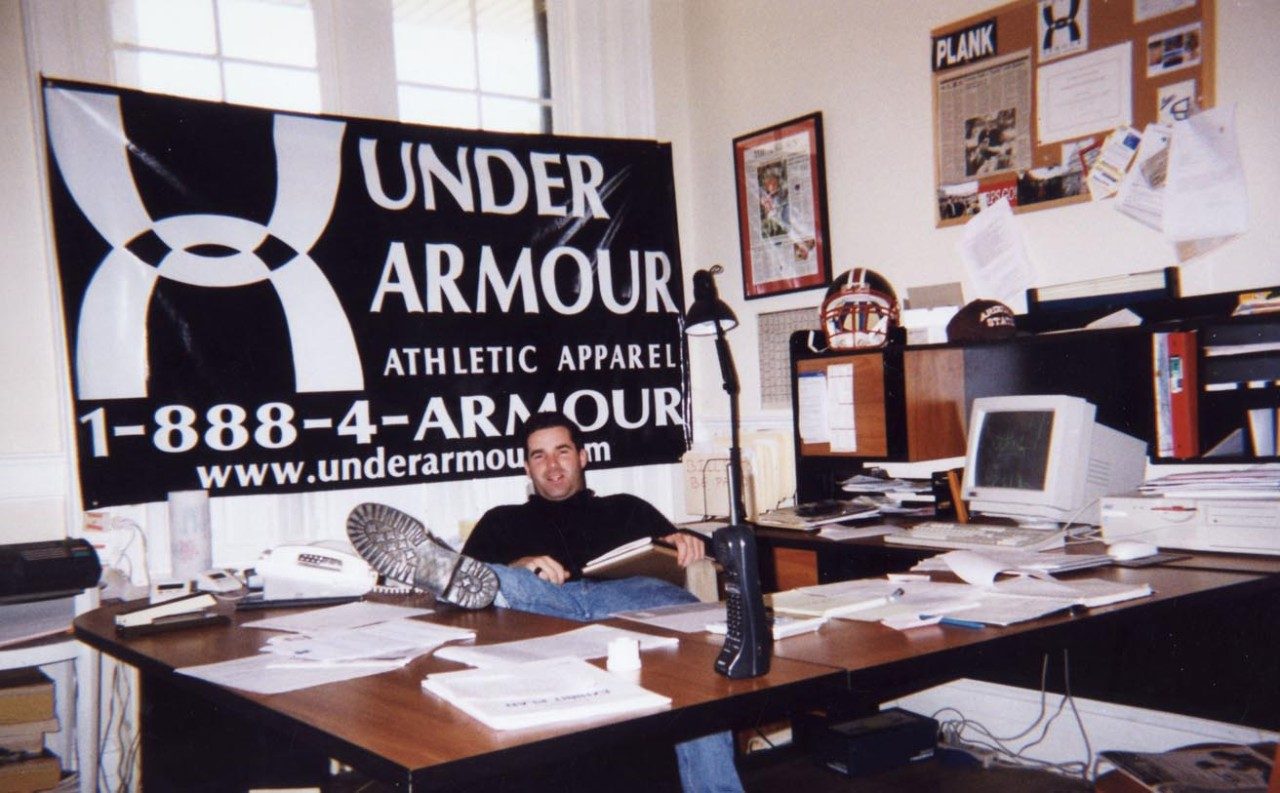

“Our first quarter results demonstrate our unwavering commitment to protecting and growing our premium performance athletic brand through a disciplined go-to-market process that delivers innovative products and experiences to make athletes better,” said Under Armour Chairman and CEO Kevin Plank. “As we execute against our long-term plan, Under Armour will emerge from 2019 and our ‘Protect This House’ chapter as an even stronger brand and company.”

First Quarter 2019 Review

- Revenue was up 2 percent to $1.2 billion (up 3 percent currency neutral).

- Wholesale revenue increased 5 percent to $818 million and direct-to-consumer revenue was down 6 percent to $331 million, representing 27 percent of total revenue.

- North America revenue decreased 3 percent to $843 million and the international business increased 12 percent to $328 million (up 17 percent currency neutral), representing 27 percent of total revenue. Within the international business, revenue was up 3 percent in EMEA (up 9 percent currency neutral), up 25 percent in Asia-Pacific (up 30 percent currency neutral), and up 6 percent in Latin America (up 10 percent currency neutral).

- Apparel revenue increased 1 percent to $775 million. Footwear revenue increased 8 percent to $293 million primarily driven by strength in our run category. Accessories revenue decreased 11 percent to $82 million primarily driven by planned lower sales of backpacks and bags related to a strategic relaunch of key product.

- Gross margin increased 100 basis points to 45.2 percent compared to the prior year driven by product cost improvements, regional mix and prior period restructuring charges, offset by channel mix.

- Selling, general & administrative expenses decreased 1 percent to $510 million, or 42.3 percent of revenue.

- Operating income was $35 million.

- Net income was $22 million or $0.05 earnings per share.

- Inventory decreased 24 percent to $875 million.

- Total debt was down 36 percent to $590 million.

- Cash and cash equivalents increased 2 percent to $289 million.

Updated Fiscal 2019 Outlook

- Revenue is expected to be up approximately 3 to 4 percent reflecting relatively flat results for North America and a low double-digit percentage rate increase in the international business.

- Gross margin is now expected to increase approximately 110 to 130 basis points compared to 2018. Excluding restructuring charges from the comparable prior period, we now expect an increase of approximately 70 to 90 basis points compared to the 2018 adjusted gross margin due to ongoing supply chain initiatives and channel mix benefits. This compares to a previously expected range of 60 to 80 basis points in improvement compared to the 2018 adjusted gross margin.

- Operating income is now expected to reach $220 million to $230 million versus the previously expected range of $210 million to $230 million.

- Interest and other expense net is now expected to be approximately $35 million versus the previous expectation of $40 million.

- Effective tax rate is now expected to be at the high end of the 19 percent to 22 percent range.

- Earnings per share is now expected to be $0.33 to $0.34 versus the previously expected range of $0.31 to $0.33; and,

- Capital expenditures are expected to be approximately $210 million.

Change to Segment Presentation

As detailed on the company’s February 12 earnings call, effective January 1, 2019, the company changed the way management internally analyzes the business and now excludes certain corporate costs from its segment profitability measures and reports these costs within “Corporate Other”.

These costs consist largely of general and administrative expenses not allocated to an operating segment, including expenses associated with centrally managed departments such as information technology, supply chain, innovation and other corporate support functions; costs related to the company's global assets and marketing; costs related to the company’s headquarters; restructuring and restructuring related charges; and certain foreign exchange hedging gains and losses. We believe this new segment presentation provides improved visibility into the underlying performance and results of our operating segments.

In conjunction with this change, certain prior year amounts have been recast to conform to the 2019 presentation. These changes have no impact on previously reported consolidated balance sheets, statements of operations, comprehensive income (loss), stockholder’s equity, or cash flows. The recast of certain unaudited historical financial information to reflect this segment reporting change can be found at https://about.underarmour.com/investor-relations.

Conference Call and Webcast

Under Armour will hold its first quarter 2019 conference call and webcast today at approximately 8:30 a.m. Eastern Time. The call will be webcast live at https://about.underarmour.com/investor-relations/financials and will be archived and available for replay approximately three hours after the live event.

Non-GAAP Financial Information

This press release refers to “currency neutral” and “adjusted” amounts. Currency neutral financial information is calculated to exclude the impact of changes in foreign currency. Management believes this information is useful to investors to facilitate a comparison of the company's results of operations period-over-period. 2018 adjusted gross margin is referred to but not presented and excludes the impact of restructuring and other related charges. A reconciliation of 2018 adjusted gross margin is available in the company’s 2018 year-end earnings release. Management believes this information is useful to investors because it provides enhanced visibility into the company’s actual underlying results excluding the impact of its 2018 restructuring plans. These non-GAAP financial measures should not be considered in isolation and should be viewed in addition to, and not as an alternative for, the company's reported results prepared in accordance with GAAP. Additionally, the company's non-GAAP financial information may not be comparable to similarly titled measures reported by other companies.

About Under Armour, Inc.

Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer and distributor of branded performance athletic apparel, footwear and accessories. Designed to make all athletes better, the brand's innovative products are sold worldwide to consumers with active lifestyles. The company’s Connected Fitness™ platform powers the world’s largest digitally connected health and fitness community. For further information, please visit https://about.underarmour.com.

Forward Looking Statements

Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, our prospects and strategies for future growth, the development and introduction of new products, the implementation of our marketing and branding strategies, and the future benefits and opportunities from significant investments. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “assumes,” “anticipates,” “believes,” “estimates,” “predicts,” “outlook,” “potential” or the negative of these terms or other comparable terminology. The forward-looking statements contained in this press release reflect our current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, levels of activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, but not limited to: changes in general economic or market conditions that could affect overall consumer spending or our industry; changes to the financial health of our customers; our ability to successfully execute our long-term strategies; our ability to realize expected benefits from our restructuring plans; our ability to effectively drive operational efficiency in our business; our ability to manage the increasingly complex operations of our global business; our ability to comply with existing trade and other regulations, and the potential impact of new trade, tariff and tax regulations on our profitability; our ability to effectively develop and launch new, innovative and updated products; our ability to accurately forecast consumer demand for our products and manage our inventory in response to changing demands; any disruptions, delays or deficiencies in the design, implementation or application of our new global operating and financial reporting information technology system; increased competition causing us to lose market share or reduce the prices of our products or to increase significantly our marketing efforts; fluctuations in the costs of our products; loss of key suppliers or manufacturers or failure of our suppliers or manufacturers to produce or deliver our products in a timely or cost-effective manner, including due to port disruptions; our ability to further expand our business globally and to drive brand awareness and consumer acceptance of our products in other countries; our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; our ability to successfully manage or realize expected results from acquisitions and other significant investments or capital expenditures; risks related to foreign currency exchange rate fluctuations; our ability to effectively market and maintain a positive brand image; the availability, integration and effective operation of information systems and other technology, as well as any potential interruption of such systems or technology; risks related to data security or privacy breaches; our ability to raise additional capital required to grow our business on terms acceptable to us; our potential exposure to litigation and other proceedings; and our ability to attract key talent and retain the services of our senior management and key employees. The forward-looking statements contained in this press release reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Under Armour Contacts:

Lance Allega

SVP, Investor Relations & Corporate Development

(410) 246-6810

Kelley McCormick

SVP, Corporate Communications

(410) 454-6624

More From UA News

Maryland Tough, Baltimore Strong

In partnership with the Baltimore Community Foundation, Under Armour has released a specially designed shirt to raise awareness and support for the short and long term needs of its community following the March 26 Key Bridge tragedy.

Another Marathon, Another Podium

On Monday, April 15th, Under Armour Athlete Sharon Lokedi finished second in the Boston Marathon during her race debut with a run time of 2:22:45, just 0:00:08 behind first. In 2022, Lokedi became the fourth woman to win the New York City Marathon in her race debut and followed that with a third-place podium finish in 2023. Traditionally specializing in the 5K, 10K, and half marathon distances, the New York City Marathon was Lokedi’s first. Now, she’s podium finished her third marathon for a 3/3 streak using the same combination of all-star preparation and performance outfitting. This year, Lokedi wore the second iteration of Under Armour’s award-winning marathon racing shoe— the UA Velociti Elite 2—and trained under Stephen Haas and Pat Casey with UA Mission Run Dark Sky Distance.

Introducing The Hat Only Under Armour Could Make

Under Armour continues to push the boundaries of innovation as it develops products that athletes cannot live without. It’s already been a busy year for Under Armour but the performance brand isn’t stopping now—Under Armour is excited to introduce the UA StealthForm Hat, a foldable travel-friendly hat engineered to fit your head, breathe easy, and wick sweat all year round. The hat is anatomically molded with seamless construction for a custom fit—and, with its unstructured design, it’s washable and completely packable, snapping back into shape with no creases with ease. Smash it in a ball and it bounces right back. This is the hat only Under Armour could make.

MiLaysia Fulwiley Signs With Curry Brand

In November 2023, MiLaysia Fulwiley made a name for herself in the basketball world when a play of her taking the ball coast to coast for a basket in South Carolina’s season opener went viral.

Under Armour Announces Leadership Transition

Under Armour, Inc. (NYSE: UA, UAA) today announced that Kevin Plank will become President & Chief Executive Officer, effective April 1, 2024.

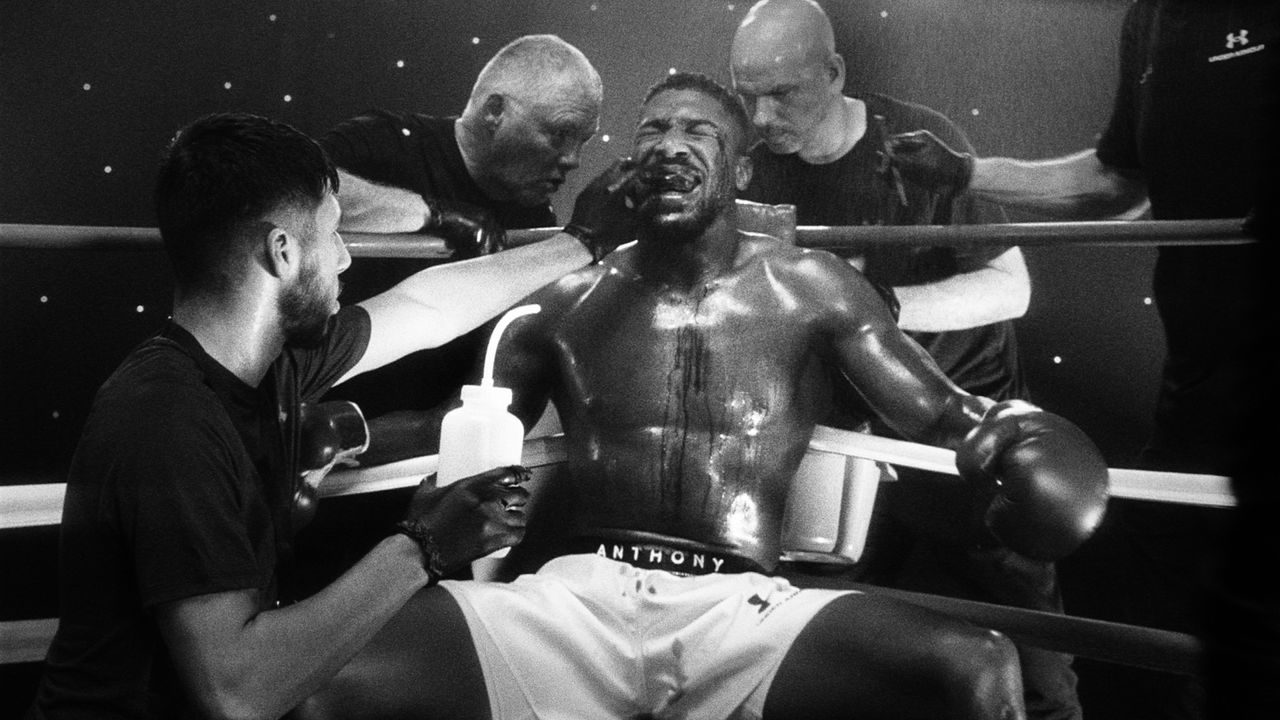

Forever Is Made Now

Under Armour has been providing AJ with leading performance solutions in and out of the ring since 2015, supporting him on his journey to become a two-time unified heavyweight world champion over the last eight years. Ahead of his ‘Knockout Chaos’ clash with heavyweight mixed martial artist and professional boxer Francis Ngannou, Under Armour marked the renewal of their long-term partnership with the release of an AI sports commercial with AJ, entitled ‘Forever Is Made Now’.

Under Armour Champions Women In Sports With Latest Collection

Under Armour stands for equality, both on and off the field and court, and has committed itself to celebrating, supporting, and championing female teammates and athletes. As an extension of that support, Under Armour, in partnership with WNBA superstars Kelsey Plum and Diamond Miller, is releasing a limited-edition product line that pays homage to female trailblazers everywhere in honor of Women’s History Month.

Curry Brand Completes 12th Court Revitalization in New York City

Curry Brand, powered by Under Armour, completed its twelfth court refurbishment at DREAM Charter School East Harlem in New York City as part of the brand’s mission to impact 100,000 youth and renovate 20 safe places to play by 2025.

Under Armour Leaves London Guessing With Holographic Unveiling Of Shadow Elite 2 Boots

Under Armour amazed the London football community with a state-of-the-art holographic presentation of its latest innovation—the Shadow Elite 2 Football Boot. At an exclusive event hosted at Village Underground, Shoreditch, UA brought together elite athletes, creators, and media for an immersive look at the future of football footwear.

The Only Shoe With 2 Modes Just Got Better

Under Armour is re-introducing the most versatile training shoes we’ve ever made with a supersized midsole for mega energy. With its convertible heel and new pumped-up midsole, the UA SlipSpeed Mega flexes between slip and speed modes with style.

Under Armour and Curry Brand are knocking down straight 3’s for this years 2024 NBA All-Star Weekend

Together the brands gear up for the 73rd Annual NBA All-Star with new, highly anticipated All-Star-inspired product and a “Curry’s Gameroom” pop-up activation dedicated to the fans

Under Armour Appoints Kevin Ross as Senior Vice President, Managing Director of EMEA

Under Armour today announced the appointment of Kevin Ross as its new Senior Vice President, Managing Director of Europe, Middle East & Africa. With nearly 20 years of experience growing high profile brands including adidas, TaylorMade, Under Armour, and Yeti, Ross brings proven talent and regional expertise to the company.

RISE TOGETHER: UNDER ARMOUR CHAMPIONS HBCUS ON AND OFF THE COURT

This February, in honor of Black History Month, Under Armour is releasing a product collection inspired by its athletes of color at the collegiate level. Designed around the legacy of African American quilting and inspired by HBCU athletes, the collection is aimed at amplifying Black voices and the brand’s ongoing commitment to empowering Black athletes year-round.

Under Armour Launches the Ultimate Endurance Collection for That Run-Forever Feel

As the brand’s newest running footwear franchise, the UA Infinite Collection is all about delivering key footwear models that support long run days as well as everyday miles. Designed as the ultimate endurance Collection, the experience is boundless, effortless and limitless on the run. From the super plush feel of UA Infinite Elite to the balanced spring and support of UA Infinite Pro, these shoes were built to help you go the distance with ease and efficiency. The overarching goal of the Infinite Elite and Infinite Pro is to make the last mile feel better than the first.

Setting A New Standard On The Green

Under Armour works closely with its golf athletes to create performance-enhancing products that meet the needs of golfers of all skill levels. Designed with direct feedback from these athletes, Under Armour is excited to announce the Phantom Footwear and Drive Pro Series, designed for golfers that are looking for that competitive edge to allow them to play like a pro, without being one.

The FUTR X ELITE sets its sights on the future of basketball

Under Armour is committed to pushing the boundaries of style and innovation to meet the needs of aspiring, recreational, and professional athletes. Now, the brand is expanding its influence with the release of FUTR X ELITE: the pinnacle footwear model within Under Armour’s basketball portfolio that will redefine the category.

Celanese and Under Armour Develop Innovative New NEOLAST™ Fiber for Use in Performance Stretch Fabrics

Celanese Corporation, a global specialty materials and chemical company, and Under Armour, Inc., a global leader and innovator in athletic apparel and footwear, have collaborated to develop a new fiber for performance stretch fabrics called NEOLAST™. The innovative material will offer the apparel industry a high-performing alternative to elastane – an elastic fiber that gives apparel stretch, commonly called spandex.

Under Armour Bolsters Leadership Team with Appointment of New Chief Product Officer and New President of Americas

Under Armour, Inc. announced two new leadership appointments: Yassine Saidi as Chief Product Officer and Kara Trent as President of the Americas. Saidi will join the company on Jan. 29, and Trent, currently serving as the managing director of the company’s EMEA region, will assume her new role in February. Both will report directly to President and CEO Stephanie Linnartz.

FC Barcelona Rising Star Fermín López Joins Under Armour's Growing Football Roster

Fermín López becomes the latest athlete to join Under Armour's rapidly expanding roster of young, up-and-coming elite football players. The Spanish midfielder joins the likes of Antonio Rüdiger (Real Madrid), Ansgar Knauff (Eintracht Frankfurt), Malick Thiaw (AC Milan), Eddie Nketiah (Arsenal), Lewis Hall (Newcastle) and Anna Patten (Aston Villa), all of whom were signed by Under Armour in recent months.

Under Armour’s Breakthrough Fiber-Shed Test Method Now Available For Industry

Following years of research in its innovation lab, earlier this year Under Armour announced a breakthrough fiber-shed test method to help address the invisible, but daunting sustainability threat microfibers and microplastics pose to society and the planet. Now, the brand has teamed up with James Heal, a leading precision testing solutions supplier, to bring its award-winning test method to life.

Curry Brand Honors Hollywood Icon Bruce Lee

Mexican Soccer Champion Sebastián Cordova Joins the Under Armour Athlete Roster

Under Armour welcomes Mexican soccer player and current La Liga MX champion Sebastian Cordova to its athlete roster. Córdova, who also plays for Mexico’s National Soccer Team, will be part of the brand’s soccer campaigns in both Mexico and the Hispanic markets in the United States.

Nothing Hits Like the Original: Under Armour HeatGear OG

The new HeatGear OG utilizes the fit and fabric of the 1996 apparel – it’s thicker, more compressive, and ultra-cooling. This iteration brings Under Armour’s learnings and the needs of a new generation of athletes to life within the iconic cut of the original HeatGear.

Under Armour Unveils Custom Navy Football Uniforms Ahead of 2023 Army-Navy Game

The Army–Navy football game, presented by USAA, an enduring and cherished tradition in American sports, is about to see its 124th match-up. This epic showdown not only symbolizes the fierce rivalry between two of the nation's most esteemed military academies but also serves as a poignant reminder of the camaraderie and shared commitment of these future leaders in uniform. Under Armour, renowned for its innovation in athletic apparel, will once again partner with the Navy football team to outfit the Midshipmen.

Under Armour Embraces the Cold for NFL Weekend in Frankfurt

For the second year that the NFL International series visited Germany, Under Armour celebrated the sporting moment in Frankfurt by demonstrating how the brand pioneered the Baselayer back in 1996 and how it has since developed that technical product into today’s ColdGear Baselayer.

Curry Brand + TUFF CROWD Join Forces

Stephen Curry is making waves within the apparel space. From his tunnel walk arrivals to his looks on the links, Stephen has long had an eye for fashion. On the heels of the release of his 11th signature shoe with Under Armour—the Curry 11—Stephen and Curry Brand are now gearing up for his latest fashion endeavor, a collaboration with luxury streetwear brand TUFF CROWD.

Under Armour and Richfresh Unveil Custom Suits for University of Notre Dame and University of South Carolina Paris Match Up

As the women’s basketball teams from two Under Armour-sponsored schools—The University of South Carolina and The University of Notre Dame—go head-to-head in the Oui Play Classic in Paris, France on November 6, there’s never been a better time to raise awareness and make a statement. Under Armour is partnering with luxury tailor and designer, Richfresh, to elevate these athletes’ off and on-the-court experience by outfitting them in suits fit for the pros.

Under Armour Doubles Military and First Responders Discount Ahead of Veterans Day Weekend

In recognition of Military Family Appreciation Month and the upcoming Veterans Day holiday, Under Armour is offering military and first responders up to 40% off their purchases. Between now and November 19, the brand has doubled its in-store military and first responder discount from 20% to 40% at all UA Brand Houses and online, and from 10% to 20% at all UA Factory Houses.

De’Aaron Fox Signs with Curry Brand

Together, De’Aaron, Stephen, and Curry Brand will partner to collaborate and expand Curry Brand’s reach across the basketball space and beyond. With a shared respect and a joint passion for making an impact on and off the court, the All-Stars will evolve their relationship from competitors to partners.

Stephen Curry Armours Up for the 2023-24 Basketball Season

When Stephen Curry requested more compression sleeves to support an injury, Under Armour answered the call in less than 24 hours.

Under Armour Basketball Athletes Become WNBA Champions

Scoring 70 points to take home the 2023 WNBA Championship for a second year in a row, UA Basketball Athletes Kelsey Plum and Cayla George led their team to victory with a three to one win in a five game series over New York. Wednesday night’s win cements Las Vegas’ status as the first team to win back-to-back titles since Los Angeles in 2001 and 2002.

Jarace Walker Joins the Under Armour Athlete Line-Up

Under Armour is thrilled to announce that Jarace Walker— professional basketball player and rookie standout, power forward for Indiana, and familiar face around Under Armour since his high school days—is an official UA athlete. Both Jarace Walker and Under Armour look forward to pulling from a collective experience to chart a new course for up-and-coming athletes.

Under Armour Appoints Gap Inc. Veteran, Shawn Curran as New Chief Supply Chain Officer

Today, Under Armour announced that following a comprehensive search and interview process, retail industry veteran Shawn Curran will join Under Armour as Chief Supply Chain Officer, reporting to President and CEO, Stephanie Linnartz.

The Future of Curry Starts Now

On Friday, October 13, Stephen, Curry Brand, and Under Armour will release the 11th iteration in his signature shoe portfolio, marking a monumental milestone that puts Stephen and Under Armour in an elite class of signature shoe lines alongside other basketball greats. Leveraging a futuristic design that celebrates the Future of Curry and his everlasting impact on basketball culture, the Curry 11 boasts a bold and disruptive flair, with the technology needed to fuel hoopers’ performance on the court.

Ripken Baseball Names Under Armour Exclusive Apparel Partner

Ripken Baseball®, the leader in sports experiences, announced they have entered a multi-year partnership with Under Armour® (NYSE: UA, UAA) to be the exclusive apparel company for Ripken Baseball’s six properties, hundreds of tournaments, and multisport events.

When In Doubt, Protect This House

Six months after Protect This House officially re-entered the global sports vernacular, Under Armour has teamed up with Minnesota superstar wide receiver, Justin Jefferson, and legendary record producer, London On Da Track, to record and release a new iteration of the iconic rallying cry to show the world what it really feels like to be an elite athlete in today’s game.

Under Armour Publishes FY2023 Sustainability & Impact Report

Under Armour, Inc. today published its FY2023 Sustainability & Impact Report, providing a progress update on 23 goals the company announced in 2022 as part of its work to reduce the environmental footprint of its products and operations while accelerating its social and community impact.

Under Armour Announces John Varvatos as Chief Design Officer

Today, Under Armour is proud to announce that fashion industry veteran John Varvatos will join the company as Chief Design Officer, effective September 11, 2023. Varvatos started consulting for UA earlier this year and brings his deep expertise in style and form to the company. Varvatos will lead the creative design direction of the company and oversee the design studios in New York, Baltimore and Portland, Oregon.

Eddie Nketiah Celebrates New Under Armour Partnership By Opening Latest Under Armour Brand House on Oxford Street

Baltimore Ravens & Under Armour Unveil Custom Uniforms for Inaugural Season of Girls' Flag Football with Frederick County Public Schools

The Baltimore Ravens and Under Armour joined forces to provide custom uniforms for female student-athletes as part of the inaugural season of girls’ flag football with Frederick County Public Schools (FCPS).

Under Armour Creates the Ultimate Team Talk Using the Power of AI

Top Boy star and football fan Ashley Walters brought the speech to life with his iconic voice, combining the powers of man and machine in an innovative and authentic manner.

Curry Camp Convenes Basketball's Best in the Bay Area

Over the weekend, Stephen Curry headed to the courts at Menlo Park to put on his annual elite hands-on training, giving youth hoopers the opportunity of a lifetime to learn from and play alongside the three-point king himself.

Under Armour and Notre Dame March On Together

It has been nearly a decade since Under Armour and Notre Dame joined forces in a partnership that epitomized the union of tradition and performance. With the vision to elevate and inspire student-athletes, UA and the Fighting Irish have renewed their partnership in an agreement that reflects their shared commitment to authenticity, innovation and achievement.

Diana Flores Joins Under Armour as the First Flag Football Global Ambassador

Under Armour welcomes Diana Flores, world flag football champion, as a new Global Ambassador addition to UA Athlete roster. Flores is the first flag football athlete to join the Under Armour family and, at 25 years old, is an inspiring example of the resilience and dedication it takes for young athletes to always strive for more.

A New Way to Score More

Beginning July 31, Under Armour’s U.S.-based consumers will have a new way to score more with the launch of Under Armour’s “UA Rewards” loyalty program. In Under Armour’s drive to Make Athletes Better, our most loyal consumers will be able to connect to the brand in new and rewarding ways.

Ready For Battle

The biggest stage in the world has arrived for female global football players. Every practice, training session, and qualifier has gotten them to this point with their hopes and hard work laid out for everyone to see. The Women’s World Cup not only showcases the best athletes around the globe but provides a well-earned chance for the world to celebrate their success.

Under Armour Basketball Is Coming to WNBA All-Star Weekend in Las Vegas

Under Armour, Kelsey Plum and Diamond Miller are ready to turn up the heat in Las Vegas for the upcoming WNBA All-Star Weekend. To celebrate the sport and encourage even more young athetes to get involved in women’s basketball, UA will host various opportunities for fans of all ages to engage with some of UA’s top women’s basketball stars and truly learn what it means to Protect This House.

Under Armour Announces Changes to Executive Leadership Team

Under Armour, Inc. (NYSE: UA, UAA) today announced a series of senior executive leadership team changes supporting the company's Protect This House 3 (PTH3) strategy.

Future 50 Cranks Up the Preseason Heat

Back for its 8th year, the elite football camp welcomed 50 of the best juniors and seniors in high school football to one of the most coveted events in the UA Next circuit.

Welcome to the SqUAd: Diamond Miller, Laeticia Amihere, and Marina Mabrey

As the confetti settles on a record-breaking women’s college basketball season and the WNBA season tip off gets underway, Under Armour is keeping the momentum of women’s basketball on fire both on and off the court.

Manchester United Defender and Canadian Gold Medalist Jayde Riviere Joins Under Armour Roster

At just 22-years-old, Jayde Riviere of Pickering, Ontario, Canada, already has a storied international career and she’s just getting started. She was part of the Canadian gold medal-winning squad at the 2020 Summer Olympics, has represented Canada at the FIFA World Cup, and most recently, has signed with Manchester United FC through to the 2024-25 season.

Anthony Joshua Gets Under Armour’s Search for London’s Future Athletes off to Smashing Start

Under Armour athlete Anthony Joshua unveiled the home for Under Armour (UA) Next, an athletic programme designed to identify, train, and develop London’s young athletes and sports leaders of tomorrow.

(DAWG) CLASS POWERED BY UA NEXT IS IN SESSION

Born out of her now famous ‘dawg mentality’ and a need for a smoother transition to pro basketball that Kelsey experienced firsthand, Under Armour and Kelsey Plum recently hosted the inaugural Dawg Class powered by UA NEXT. Held at IMG Academy, this three-day camp set out to help women college athletes navigate their journey from college basketball to the professional level. Inspired by Kelsey’s jersey #10, Kelsey engaged on and off the court with nine of the top women’s college basketball guards, providing them with the tools and insights to succeed as a first step to increasing equity in sports.

Antonio Rüdiger Joins Under Armour Roster

Rüdiger is now wearing the Under Armour Clone Magnetico Pro 2 boot, and the brand is committed to helping him be the best he can be on the football field week in, week out.

A Golf Season Unlike Any Other

Professionals like Jordan Spieth have come to rely on Under Armour for technologies and innovations that provide that extra edge on the greens. As the golf brand for athletes, Under Armour knows exactly what the seasoned pro and the beginner need to take their game to the next level – whether you’re playing at Augusta or on your local course.

Under Armour and Stephen Curry Lock In Groundbreaking Partnership

Under Armour and Stephen Curry became a team in 2013. What started as an underrated point guard only a few years into the league, and a challenger brand looking to shake up the sporting industry, has become an iconic partnership with disruption and innovation at its core. Now, the two have amplified their unique partnership even further, forging a long-term commitment to serve athletes and communities and drive mutual success for years to come.

Under Armour Calls On A New Generation To Protect This House

With the help of current and future basketball legends Stephen Curry, Kelsey Plum, Aliyah Boston, and Bryson Tucker, Under Armour is bringing back Protect This House.

Trent Alexander - Arnold Smashes Open New Under Armour Brand House in Liverpool

Under Armour has launched its first UK Brand House at Liverpool ONE in emphatic style. To mark the occasion, Under Armour athlete and dead ball specialist Trent Alexander-Arnold took on the challenge of taking a free-kick to smash open the windows and officially launch the new store.

Under Armour Announces New Methodology to Measure Fiber Shedding

Under Armour, Inc. today announced it has developed a new testing methodology to help fight fiber shedding at its source and support progress toward the company’s sustainability goal for 75% of fabrics in its products to be made of low-shed materials by 2030. Under Armour’s innovative test method offers a simplified process to accurately measure a fabric’s propensity to shed.

Introducing Dawg Class with Kelsey Plum

To pave the way for young women and show them what a future in sports can look like, Under Armour and Kelsey Plum are launching the inaugural Dawg Class. Hosted at IMG Academy in April, this mentorship program will help women college athletes navigate the transition to the professional level.

Under Armour and City Schools Celebrate Project Rampart

Today Under Armour and City Schools celebrated Project Rampart, an ongoing six-year partnership designed to elevate the City Public High School student athlete experience and improve academic outcomes through the power of sport.

Under Armour Joins Ellen MacArthur Foundation, Highlights the Importance of Advancing Circularity

Embracing a circular business model is critical to the future of the planet and to the apparel, footwear, and accessories sector. By optimizing resources and working to extend the lifespan of products, companies can accomplish more with fewer inputs – effectively reducing waste and consumption to support people and the environment.

Equality Has No Offseason

At Under Armour, ‘Stand for Equality’ has always been a core value, meaning we stand with underrepresented groups, such as the LGBTQIA+ community, year-round and remain committed to creating better representation in sport, around the world, and in our own community.

Under Armour Disrupts NYC Market With Innovative New Retail Experience In The Heart of Manhattan

Transcending the typical shopping experience, the UA Flatiron Pop-Up provides a physical manifestation of what Under Armour is all about - creating fearlessly with the courage and conviction to defy convention, innovating by taking bold and smart risks, and showing up big where athletes train, compete, and recover.

To the Greatest of All Time: Tom Brady

A legendary example of the dedication and focused mindset needed to turn a passion into an accomplished career, Tom Brady took a moment to in an emotional beach-side video to let his fans know that he was "retiring for good."

Under Armour Appoints Carolyn Everson and Patrick Whitesell to its Board of Directors

Under Armour, Inc. (NYSE: UA, UAA) today announced the appointment of Carolyn Everson and Patrick Whitesell as members of its Board of Directors effective Feb. 1, 2023. In addition, longtime member Harvey Sanders will retire from Under Armour's Board on March 31, 2023.

UA Elevates the Game to Reach More HBCU Student Athletes Off the Court, Uplift Vision of Black Teammates and Voices of Community Partners

Under Armour believes that the power of sport can unite, inspire, and change the world. We are on a mission to empower the voices of our underrepresented athletes, teammates, and communities in our ongoing effort to Stand for Equality. We continue to celebrate the importance of Black History Month by delivering upon this mission.

An Inside Look At UA Next All-America Week 2023

Back for its 15th year, Under Armour gathered 26 of the best high school volleyball players and top 100+ high school football players in the nation in Orlando, Florida for its annual UA Next All-America Week. Providing a unique mix of world-class experiences and accommodations, access to elite instruction and coaching, and next level competition and exposure for these athletes, the week-long experience provided the next generation of athletes with an opportunity to elevate their mental and physical game.

UA Is Joining Forces with Seth Curry, Jordan Thompson and Fleur Jong to Motivate Athletes to Get ‘Real Tough’ and Achieve Their 2023 Goals

Under Armour is empowering and motivating athletes everywhere to harness that “Real Tough” mindset and level up to their goals this year by teaming up with three UA athletes who know a thing or two about pushing past their limits. Brooklyn guard Seth Curry, gold medalist and volleyball player Jordan Thompson and Netherlands Track & Field para-athlete Fleur Jong, are showing athletes everywhere how they find their “Real Tough” mindset in a series of inspiring content that provides a rare look at the inner mantras that drive them, the physicality of their training and the unwavering dedication they maintain to perform at their best.

Under Armour Announces Stephanie Linnartz as President and CEO

Stephanie Linnartz will join Under Armour as President, Chief Executive Officer, and member of its Board of Directors, effective February 27, 2023.

UA Welcomes The Next Generation Of Athletes No One Saw Coming To Baltimore Headquarters

Today athletes are faced with challenges both on and off the field. Spurred by social media there is more noise than ever and the youth athletes of today are faced with comparisons at every turn. Rising above the noise, the most confident athletes all have one thing in common - they forge their own path to greatness.

Under Armour’s Sharon Lokedi Wins NYC Marathon In Distance Debut

On Sunday, November 6, Sharon Lokedi, of UA Mission Run Dark Sky Distance won the 2022 New York City Marathon wearing a World Athletics-approved prototype of the next iteration of the UA Flow Velociti Elite, with a time of 2:23:23. Traditionally specializing in the 5k, 10k, and half marathon distances, the NYC Marathon was Lokedi’s marathon debut and a celebration of a long journey to compete.

Under Armour Adds Kelsey Plum to its Roster

Kelsey’s new partnership with Under Armour is a perfect alignment of two forces that rally for the underdog and believe in the transformative power of sport.

Introducing UA SlipSpeed, Under Armour’s Most Versatile Training Shoe Designed for Athletes

Under Armour aims to inspire athletes with performance solutions they never knew they needed and now can’t imagine living without. Listening to our athletes and making their problems ours to solve, UA set out to develop a multi-dimensional shoe that can become what the athlete needs it to be exactly when they need it. The result was UA SlipSpeed™ - a performance trainer with a convertible heel design.

Under Armour Sparks Confidence in Young Female Athletes

Hype Headquarters is just one piece of Under Armour’s larger Access to Sport commitment to break down barriers and create opportunities for millions of youth to engage in sport. Through this event and future efforts, the brand has committed to increasing equity in sport by providing more youth athletes with game-changing product solutions. This event kicks off a multi-year initiative designed to help 1,200 young female athletes during its first year.

Coalition Academy

Coaches are elemental to the success of their team and the motivation of their players. But unfortunately the playing field is far from level. Minority football players and even the fans at home don’t see themselves represented on the sidelines. That needs to change.

UA and Stephen Curry Go 10 For 10

This season was a remarkable one for Stephen Curry as he continued to reach new heights in his basketball career. After cementing himself as the best three-point shooter in league history, Stephen took home his fourth NBA Championship title and unanimously clinched the honor of Finals MVP. It’s only fitting that he will top off the year by eclipsing another milestone: the launch of the Curry Flow 10 – his tenth signature shoe with Under Armour and third under Curry Brand.

The Heartbeat of the Huddle: Empowering Minority Coaches

Diversity, equity, and inclusion are foundational to every industry. Yet these terms are almost exclusively used in corporate offices and boardrooms. While private businesses appoint board members with diverse backgrounds and create action plans, the sports world is being left in the dust.

The All-Star No One Saw Coming

Most of the greatest successes in life and in sports are brought on by a profound change. And these big changes don’t come easily—a willingness to adapt takes bravery and determination. Finding comfort in the unknown allows us to live out our true potential instead of cowering from the next big move. Joel Embiid has allowed change to propel him forward and never let comparisons slow him down. Through the new Athlete No One Saw Coming campaign, Under Armour wants youth athletes to do the same and keep moving as they forge their own paths to greatness.

Project Rock is Raising the Bar

The Project Rock Black Adam Training Collection is inspired by Dwayne’s ferocious dedication and relentless passion for his craft. Like Black Adam himself, the collection represents grit, determination, hard work and most importantly, disruption; and aims to inspire athletes to disrupt the status quo in their own lives, in and outside of the gym.

As Women’s Basketball Evolves, Under Armour Answers the Call

The steps of the female athlete are freshly-pioneered and all her own. Female basketball stars set a new course for the sport every time they step onto the court—their direction unmoored by men’s sports. There may be no better example than women’s basketball. In recent years, it’s become an entirely new game. As players move towards a position-less role and star power on the court increases, female athletes need a versatile shoe that not only heightens their performance but shows off their style and personality. Enter the UA Flow Breakthru 3: innovative footwear tailored to the specific needs and individual expression of female MVPs on the basketball court. Few players exemplify this combination of personal style and gametime performance like the face of this third generation shoe, power forward and NCAA Champion Aliyah Boston.

Under Armour Releases 2021 Sustainability & Impact Report, Outlines New Strategic Framework, Goals, and Targets

BALTIMORE, Sept. 27, 2022 – Under Armour, Inc. (NYSE: UA, UAA) today announced the release of its 2021 Sustainability & Impact Report, outlining a new sustainability framework, goals, and targets that will guide the company’s work to reduce the environmental footprint associated with its products and operations while accelerating its social and community impact. Aligned with Global Reporting Initiative (GRI) and Sustainable Accounting Standard Board (SASB) industry standards, the report outlines 23 goals and targets designed to drive company progress across three key pillars – Products, Home Field, and Team – and underscore Under Armour’s core values, including ‘Act Sustainably’ and ‘Stand for Equality.’ “As a global innovator and leader in athletic performance apparel, footwear, and accessories, we believe Under Armour has an important role to play in addressing impending challenges facing our society, industry, and planet. This belief informs our innovation methods and compels us to rethink, reinvent, and reimagine our products and how we make them in our work to support athletes and protect people and our shared planet,” said Colin Browne, Under Armour Interim President and CEO. “Mindful that lasting change will require global cooperation across communities and industries, our new report conveys our renewed commitments to continuous improvement, industrywide collaboration, and transparent communication with our stakeholders in our ongoing sustainability journey.” Under Armour’s sustainability approach, What’s Under Matters, reflects the company’s mission to make athletes better by focusing on performance-driven innovations that utilize more sustainable materials designed for recyclability and more efficient production processes in its delivery of durable, quality, high-performing products athletes know and trust. “The details underlying a company’s sustainability strategy are foundational to its longevity and ability to generate lasting impact. For this reason, Under Armour has worked diligently over the years to finalize our approach and take concerted action before releasing this report,” said Michael Levine, Under Armour VP and Chief Sustainability Officer. “We’re pleased to share our accomplishments and perspective on our future goals, and we look forward to providing updates on our progress.” A selection of report highlights within each pillar follows: Products – Through 10 goals, the company is embracing material innovations that will enable less waste and more durability, setting the stage for circular systems by 2030, including: Prioritizing recycled and renewable materials and reducing single-use plastic brand product packaging by 75% by 2025. Implementing sustainability and circular design principles in at least half of its products by 2027 and developing chemistry and processes that can enable a circular footwear program to be launched in market, at scale, by 2030. At the end of 2021, approximately 40% of fabrics used in the company’s apparel and accessories were made from materials capable of being recycled. Supporting innovation that reduces fiber shedding from textiles and targeting 75% of fabric to be made of low-shed materials, as defined by industry-leading guidance on fabric shedding that the company will work collectively to shape by 2030. Home Field – The company is working to reduce its overall environmental footprint and do its part to protect the planet through seven goals, including: Eliminating 100% of biocides and fluorine DWR in its products by 2025. Reducing absolute scope 1, 2, and 3 greenhouse gas emissions by 30% and increasing renewable energy in owned and operated facilities to 100% by 2030. Advancing low-impact manufacturing, reducing the environmental impact of its materials, and targeting net-zero emissions by 2050. Team – The company is supporting its people and communities through six goals that build upon longstanding efforts, including: Continuing to invest in teammates' health, safety, and well-being – including through initiatives to advance diversity, equity, and inclusion and develop underrepresented talent at all levels. Protecting workers' human rights and well-being in its supply chain through comprehensive programs and audits. Working to create opportunities for millions of youth to engage in sports by 2030. To download the 2021 Sustainability & Impact Report and for further information on Under Armour’s sustainability program, visit this link. About Under Armour Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer, and distributor of branded athletic performance apparel, footwear, and accessories. Designed to empower human performance, Under Armour's innovative products and experiences are engineered to make athletes better. For further information, please visit http://about.underarmour.com. Forward-Looking Statements Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, estimates, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, such as statements regarding our goals, targets, commitments, future planned initiatives and the timing and effectiveness of any of the foregoing, including those relating to the environment, human capital matters, social and labor issues, and community impact; the development and introduction of new products, technologies and ways of working; our assumptions and the implementation of our sustainability strategies; the future impacts of our investments and initiatives; and the standards and expectations of third parties. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “outlook,” “potential,” or the negative of these terms or other comparable terminology. The forward-looking statements contained in this press release reflect our current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, activity levels, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including our assumptions not being realized, scientific or technological developments, evolving sustainability strategies, evolving government regulations, and the risks and uncertainties set forth in the “Risk Factors” section of our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission. The forward-looking statements contained in this press release reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the statement's date or to reflect unanticipated events.

The Gold Medalist No One Saw Coming

Comparisons aren’t the same thing as motivation. In fact, comparing athletes to one another distracts from the unique qualities that make an individual perfectly suited for greatness. But what happens when you can’t escape these expectations? What if you’re born into an athletic legacy but want to pave your own path? Through the new Athlete No One Saw Coming campaign, Under Armour wants youth athletes to focus on their own game and block out the toxic comparisons they’re faced with each day. No athlete is more familiar with this pressure than Gold Medalist Jordan Thompson.

Run-to-Compete In The All New UA HOVR Phantom 3

Under Armour introduces the all new UA HOVR™ Phantom 3: a neutral, responsive running shoe designed for specialty athletes training to compete—those who would do anything to improve in the offseason so they may perform at their best in season. Fully tested and validated by UA Athletes, the UA HOVR™ Phantom 3 maintains the Phantom’s reputation as UA’s most versatile running shoe. It delivers the speed and propulsion that athletes demand from a performance running shoe while maintaining the comfort and stability needed from a training shoe. In developing the UA HOVR Phantom 3, the footwear design team analyzed the demands of the sport-driven athlete who is hitting the pavement through short runs and intervals as part of a comprehensive training regimen. The HOVR Phantom 3 seamlessly transitions from treadmill to gym, making it a must have for athletes who run for sport.

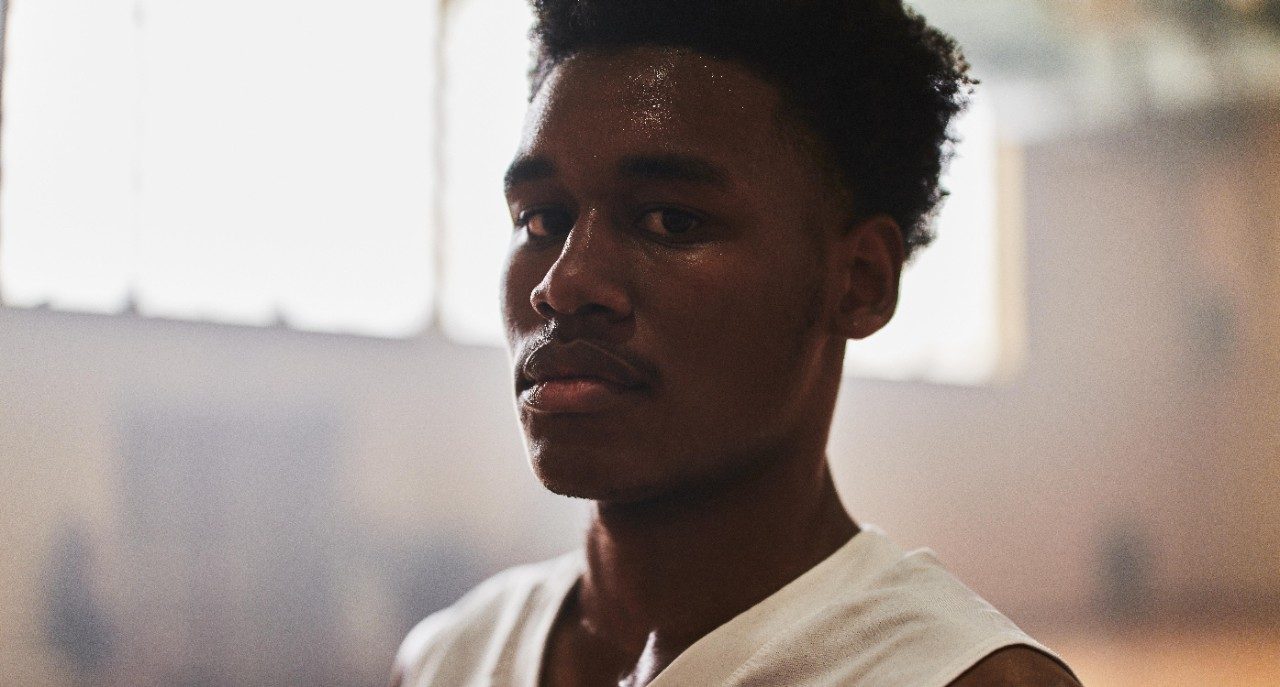

Empowering the Next Generation to be The Athlete No One Saw Coming

A segment on a sports show. A whisper on the sideline. A post on a social media feed. Athletes experience comparisons everywhere concerning just about anything—their form, their record, their presence on the team. Which All-Star do they most resemble? How does their technique stack up to the Greats? Will they be the GOAT or a bust? Comparisons are no longer used for context, they’re now confused with competition. Combating this long-standing and increasingly toxic trend, Under Armour has created a rallying cry to fuel self-confidence in youth athletes by empowering them to Be The Athlete No One Saw Coming in their latest campaign. Focused on encouraging young athletes to look beyond the comparisons and focus on their biggest competition - the athlete in the mirror - the campaign marks another important milestone in Under Armour’s ongoing mission to make athletes better.

Under Armour Makes Maro Itoje Better

Last month, ahead of pre-season with his club – Saracens – and in preparation for the France 2023 Rugby World Cup, Under Armour athlete and England International Maro Itoje travelled to Portland, Oregon, for a 10-day pre-season camp at the Under Armour Human Performance Centre. A world-class facility built for performance excellence, the Human Performance Institute hosts UA’s best athletes, who come to be assessed and learn about how they can become better. In the months leading up to the camp, Under Armour’s Human Performance Team worked with both Saracens and the England Rugby Football Union to build a program for Maro that best prepares his body and his mind for rugby pre-season. The training program focused on three elements: supporting Maro’s basic aerobic conditioning, improving his breathing and movement efficiency, and facilitating injury prevention.

Curry Brand Takes Court Revitalization Efforts to Stephen’s Alma Mater

Curry Brand, powered by Under Armour, is taking on its ninth court refurbishment at the Ada Jenkins Center in Davidson, North Carolina, as part of the brand’s mission to impact 100,000 youth and renovate 20 safe places to play by 2025. The project kicked off at a special time for Stephen, as he returned to his alma mater to be inducted into the Davidson College Hall of Fame and receive his diploma. The court will be refurbished in partnership with Stephen and Ayesha’s Eat. Learn. Play. Foundation and The Summit Foundation, both of which share Curry Brand’s mission of ensuring all kids have access to safe places to play.

Under Armour Brings Together the Next Generation of Basketball Stars at Elite 24

On August 12, Under Armour hosted its Elite 24 event in Chicago, bringing together 48 of the nation’s best rising boy’s and girl’s high school basketball players. As a brand dedicated to supporting the next generation of athletes, Elite 24 provided a venue for the future’s brightest stars to showcase their skills on the national stage and rise to the ranks of the nation’s top high school performers on the court.

Stephen and Snoop Team Up for Youth Hoops

Today, more than 70 kids received the surprise of their lives when four-time NBA Champion Stephen Curry and entertainment icon Snoop Dogg unveiled a newly refurbished basketball court at the Boys & Girls Clubs of Long Beach facility in Martin Luther King, Jr. Park. While the court had spent years in need of repair, it shined during today’s unveiling as kids took to the hardwood for the first time in more than a month to engage in hands-on skills programming through the support of Curry Brand, powered by Under Armour, on its mission to impact 100,000 youth and renovate 20 safe places to play by 2025. Since the launch of Curry Brand in 2020, Stephen and Snoop have been ideating ways they could collaborate and combine their shared passion for providing access to youth sports. Over the past two years, they remained close as they brought their vision to life, utilizing their collective platforms to make a meaningful impact in the lives of others.

Curry Camp Returns to Bring Top Youth Talent Together In San Francisco

Following a two-year hiatus, Stephen Curry’s hands-on training camp returned for the top high school basketball players in the country. One of the many ways Stephen gives back to the game he loves, Curry Camp provides mentoring for elite youth basketball athletes, empowering them on their journey to compete. The four-time NBA champion personally invited 26 boys and girls from across the country to receive 1:1 coaching from the three-point king himself alongside a star-studded roster of coaches and trainers. Campers had the opportunity to show off their skills while practicing and playing with some of the sport’s best, including former Los Angeles Lakers player Kent Bazemore and recently retired Davidson College head basketball coach Bob McKillop, who also served as Stephen’s coach while at Davidson from 2006-2009.

Fast Just Got Faster With New Run Footwear Innovation From Under Armour

To give every stride more purpose, efficiency, momentum, and acceleration, UA set out to break the tape with the development of a new marathon shoe: the UA Flow Velociti Elite. This revolutionary shoe features award-winning UA Flow technology and is redefining fast for pro athletes chasing the finish line during race season.

Inspired by the Court, Built for the Course

Golf has historically been dominated by male players outfitted in traditional apparel. For the past five years, Stephen Curry has been working to change that by championing inclusivity in the sport and injecting personality-filled apparel to offer a more seamless transition from everyday streetwear onto the course. The new Curry Brand Fall/Winter 2022 collection includes five pieces that combine the same style elements and assets that propel Stephen on the court with popular, course-ready streetwear to achieve maximum performance. Players will notice the inspiration drawn from a basketball uniform through the collection’s use of monochromatic, head-to-toe uniformity and striking side details. The nods to streetwear show up via splashes of bold prints and trend-driven silhouettes. At the core of every piece of the collection is performance – from stretchy, quick-drying fabric to wind-resistant material and comfortable knits, the collection helps golfers perform at their best without sacrificing style.

Juan Soto Takes the T-Mobile Home Run Derby Crown

The MLB All Star break is underway, and Under Armour athlete Juan Soto is doing anything but slowing down with his impressive win at the 2022 T-Mobile Home Run Derby Monday night at Dodgers Stadium in Los Angeles.

Introducing Curry FloTro

When it comes to footwear, today's ballplayers want it all – style, speed and simplicity. Enter the Curry 4 FloTro, which combines style elements from the fan-favorite Curry 4 with Under Armour’s award-winning UA Flow technology. The first in a series of reimagined models set to debut this year, the Curry 4 FloTro pays homage to the shoe that propelled Stephen in some of his most historic performances. While wearing Curry 4, Stephen became the fastest player in NBA history to achieve 2,000 career three-pointers and helped the Golden State Warriors clinch the 2017 championship title during a highly anticipated rematch of the prior year’s playoffs.

Creating a Legacy Starts at Home

Aliyah Boston is one of the country's most talented and recognizable basketball players. She has come a long way from her makeshift driveway basketball court in St. Thomas, but that doesn’t mean she’s left the islands in her past. Earlier this month, Aliyah crossed yet another milestone off her list by hosting her first UA Next Basketball camp in her hometown in the Virgin Islands. Created to educate, empower and encourage athletes of all ages, backgrounds, skill and socioeconomic levels—especially youth athletes—to get out and get moving, Under Armour’s UA Next platform launched in 2021 and has since expanded to cover several team sports categories.

Outward Bound Partners with Lt. Richard W. Collins III Foundation, Under Armour for Three-Year Program with Maryland Universities

Eleven Reserve Officer Training Corp (ROTC) cadets from University of Maryland (UMD), College Park and Bowie State University (BSU) completed their five-day wilderness expedition on Friday, June 10. The expedition took the participants along a stretch of the Appalachian Trail with their Outward Bound educators. The week-long challenge was the final step in the first year of the Building Bridges program that brought together over 40 cadets from the two schools, starting with a one-day program held in September 2021 at Chesapeake Bay Outward Bound School’s (CBOBS) Leakin Park campus. The program is sponsored by Under Armour, through its UA Freedom Initiative, which focuses on supporting front-line workers, like ROTC cadets. “This was an experience of a lifetime. I took so many lessons and so much about myself. I learned and recognized that it’s okay to fall sometimes. It’s about what you do after. Getting back up and not allowing your setbacks to stop you from pushing forward. I learned so much about allowing yourself to work with others, trusting them along with yourself, and the difference it all makes in the end,” shared Kayla, an ROTC cadet from Bowie State University after completing the five-day expedition with their crew.

Bringing Purpose to Student-Athlete Partnerships

In 2021 the relationship between brands and student-athletes changed forever with the move to allow students to profit off of their name, image, and likeness (or NIL), in addition to making money from signing autographs, starting their own businesses, teaching camps or lessons, starring in advertising campaigns and posting sponsored social media content. Before this landmark decision, critics claimed for decades that compensating student-athletes would make it harder for them to focus on competition and schooling. Instead, athletes have found the new rules are not only lucrative but liberating. Now, on the first anniversary of this significant shift, Under Armour reflects on its successful roster of purpose-first, NIL partnerships and outlines its future goals for this new frontier of collegiate sports marketing.

Stephen Curry Breaks Ray Allen’s All-Time 3-Point Record

On Tuesday, December 14, 2021, Stephen Curry achieved a milestone that he’s been aiming for nearly his entire career. Sinking a three against the New York Knicks, Curry surpassed NBA legend Ray Allen’s total of 2,973 to become the all-time leader in total 3-pointers made during the regular season. It’s a moment worthy of celebration that’s also seemed inevitable for years. Widely regarded as the best shooter in the league, Curry already holds the single-season record with 402 3-pointers sunk during the 2015-16 season, and surpassed Allen’s 3-point totals for regular and post-season play in November. Just this season, he’s been averaging 5 made 3-pointers per game and managed to surpass Allen’s regular-season record in 500+ fewer games, claiming the record in just 786 games, compared to Allen’s 1300. For Curry, the shot that has transformed professional basketball in his time has become an effortless extension of his talent.

Cue the Confetti

Another milestone year is in the books for Warriors point guard Stephen Curry. The two-time NBA MVP led Golden State to a 103-90 victory over the Boston Celtics in Game 6 of the NBA Finals, earning his fourth NBA Championship title. Stephen finished the series with 34 points in last night’s game alone, including seven assists, seven rebounds and six 3-pointers, cementing himself as the NBA Finals MVP – a first for the all-time 3-point leader.

Curry Brand Launches Largest Branded Cross-Community NFT Project in History

To build one of the most vibrant basketball communities in the metaverse, Curry Brand has partnered with some of the leading and most influential brands to push the boundaries of the Web3 space by developing Basketball Headz, the first-ever minted avatars linked to real-time performance. Following last year’s unforgettable NFT debut of the Genesis Curry Flow in honor of Stephen Curry breaking the NBA three-point record, Curry Brand once again made headway in the metaverse with the recent launch of basketball-inspired NFTs – or NF3s – linked to Stephen’s on-court performance during this year’s NBA playoffs. Through June 18, fans can continue to claim one free NF3 per digital wallet, per game, each time Stephen sinks a three-pointer. Beginning Wednesday, June 22, fans who were unable to claim a free NF3 will have the opportunity to purchase one for $125 at lab.currybrand.com, while supplies last.

Under Armour Launches its First Running Shoe Made on a Women’s Last

Under Armour knows runners are looking for data driven technology that is peer-proven and road-tested to take them to the next level on their journey to compete. In 2022, Under Armour is continuing to push the run category forward through a laser focus on providing products that deliver superior performance and innovation to meet the needs of UA Run consumers, specifically those of our female athletes. Traditional women’s running shoes often derive from a men’s-designed shoe made smaller to fit the female foot. This means running shoes often lack the flexibility, fit, and arch support women need. UA Flow Synchronicity is the brand’s solution to this consumer need - built by HER, for HER and empowering HER Form, Her Speed and HER Rhythm on her journey to compete.

UA-Athlete Approved Father’s Day Gifts

The final round of the U.S. Open falling on Father's Day is a storied tradition for golfers and golf fans around the world. For Jordan Spieth, this year will be his first U.S. Open as a dad, as Jordan and his wife Annie welcomed their son Sammy into the world this past November. Taking inspiration from his own dad, who he said is his “number one role model,” and the person he credits with helping him get started in the game of golf, Jordan expects this first Father’s Day to serve as a time to reflect on how much his life and career have changed over the past six months and how his bond with Sammy has already impacted him on the course.“It’s hard to put into words what it really means to me to now be a father,” Spieth said. “Sammy doesn’t yet understand my on-course accomplishments, he just deserves the best of me as a Dad. Spending time with him and Annie helps put my mind on other things, and where it should be, which is in the moment of hanging out with people I love. I want to be the best at anything I do, and I am enjoying learning the process of trying to balance being the best person for my family alongside working to be the best golfer in the world.” Jordan’s picks include tried and true UA Golf items he has worn throughout the season: Spieth's Performance Picks Men’s UA Playoff Polo 2.0 Men’s UA Drive Pants Men’s UA HOVR Drive 2 Golf Shoes Men’s UA Braided Golf Belt

Next Level Speed and Comfort: HOVR Machina 3

Technology is always moving fast and runners’ demands are growing as the bar gets higher. Disrupting the market with innovation and meeting the athlete where they need us is what Under Armour does best. Together, our human performance and product development teams continue to bring athletes the best footwear from the UA Innovation Lab in Baltimore and UA Human Performance Center in Portland.

Under Armour Announces CEO Transition

Under Armour, Inc. (“the company”) (NYSE: UA, UAA), today announced that Patrik Frisk will step down as President and Chief Executive Officer (CEO) and as a member of the Board of Directors (board), effective June 1, 2022. The board has initiated a comprehensive internal and external search process to identify a permanent President and CEO. Until a successor is named, the board has appointed Colin Browne, the company’s Chief Operating Officer (COO), as interim President and CEO, effective June 1, 2022. To support the transition, Frisk will remain with Under Armour as an advisor through September 1, 2022. “On behalf of the board, I want to thank Patrik for his valuable contributions to Under Armour over the past five years,” said Kevin Plank, Under Armour Founder, Executive Chairman and Brand Chief. “During his tenure, we made significant strides in advancing enterprise-wide operational excellence, and Patrik’s steadfast leadership has been crucial to strengthening our foundation and positioning the company for our next growth phase. As we search for Patrik’s permanent successor, Colin’s experience as a seasoned executive in our industry and leading critical operational aspects of our business will serve Under Armour well as interim CEO.” Plank continued, “Under Armour is evolving to meet the needs of our athletes worldwide. As we transition, we are committed to identifying additional opportunities to drive improved returns for our shareholders and deliver for athletes, partners, and teammates. There is a huge opportunity in front of us. I look forward to working closely with the board during the search process to find our next leader who will take us to new heights. In the meantime, we are moving forward and will continue to connect with athletes in exciting ways, offering them exactly what they need when they need it.” Frisk, who joined Under Armour in 2017, helped architect its long-term strategic plan that underscored its commitment to athletic performance by reengineering its structure, systems, and go-to-market process. Under his leadership, the company delivered industry-leading products, deepened relationships with consumers and customers, and advanced its purpose, vision, mission, and values. “It has been the greatest privilege of my career to serve Under Armour athletes, customers, shareholders, and teammates. I am extremely proud of what we’ve accomplished as a team,” said Frisk. “Together, we have done a tremendous amount of work to strengthen this iconic brand while significantly solidifying its operations. Colin has an intimate understanding of the Under Armour business and our industry. I have every confidence that his stewardship will allow for a seamless transition.” Browne said, “What unifies and drives Under Armour is our purpose: to empower those who strive for more. This transition is an opportunity to further our long-term goals. I am grateful for Patrik’s leadership and partnership. As we work to deliver industry-leading innovation and premium experiences to athletes globally, we remain focused on amplifying the strong foundation that’s been set over the past few years.” Since joining the company in 2016, Browne modernized Under Armour’s digital go-to-market strategy and direct-to-consumer model and transformed its supply chain organization, leading to significant margin improvement and operating efficiency. Browne has held the role of COO since 2020 and oversees supply chain, global planning, sustainability, information technology, enterprise data management, commercial optimization, go-to-market strategy, and distribution capabilities. Browne has been an integral part of the company's successful transformation, and his leadership has been critical to navigating global supply challenges caused by the pandemic. About Under Armour, Inc. Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer and distributor of branded athletic performance apparel, footwear, and accessories. Designed to empower human performance, Under Armour’s innovative products and experiences are engineered to make athletes better. For further information, please visit http://about.underarmour.com. Forward Looking Statements Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, our prospects, and strategies for future growth, the impact of the COVID-19 pandemic on our business and results of operations, the development and introduction of new products, and the implementation of our marketing and branding strategies. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “outlook,” “potential” or the negative of these terms or other comparable terminology. The forward-looking statements contained in this press release reflect our current views about future events and are subject to risks, uncertainties, assumptions, and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, activity levels, performance, or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by these forward-looking statements, including, but not limited to: the impact of the COVID-19 pandemic on our industry and our business, financial condition and results of operations, including recent impacts on the global supply chain; failure of our suppliers or manufacturers to produce or deliver our products in a timely or cost-effective manner; labor or other disruptions at ports or our suppliers or manufacturers; changes in general economic or market conditions that could affect overall consumer spending or our industry; increased competition causing us to lose market share or reduce the prices of our products or to increase our marketing efforts significantly; fluctuations in the costs of raw materials and commodities we use in our products and our supply chain; changes to the financial health of our customers; our ability to successfully execute our long-term strategies; our ability to effectively drive operational efficiency in our business and successfully execute any restructuring plans and realize their expected benefits; our ability to effectively develop and launch new, innovative and updated products; our ability to accurately forecast consumer shopping and engagement preferences and consumer demand for our products and manage our inventory in response to changing demands; loss of key customers, suppliers or manufacturers; our ability to further expand our business globally and to drive brand awareness and consumer acceptance of our products in other countries; our ability to manage the increasingly complex operations of our global business; the impact of global events beyond our control, including military conflict; our ability to successfully manage or realize expected results from significant transactions and investments; our ability to effectively market and maintain a positive brand image; our ability to effectively meet the expectations of our stakeholders with respect to environmental, social and governance practices; the availability, integration and effective operation of information systems and other technology, as well as any potential interruption of such systems or technology; any disruptions, delays or deficiencies in the design, implementation or application of our global operating and financial reporting information technology system; our ability to attract key talent and retain the services of our senior management and other key employees; our ability to access capital and financing required to manage our business on terms acceptable to us; our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; risks related to foreign currency exchange rate fluctuations; our ability to comply with existing trade and other regulations, and the potential impact of new trade, tariff and tax regulations on our profitability; risks related to data security or privacy breaches; and our potential exposure to litigation and other proceedings. The forward-looking statements contained in this press release reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the statement’s date or to reflect unanticipated events. Under Armour Contacts: Lance Allega, SVP, Investor Relations & Corporate Development, (410) 246-6810 Blake Simpson, SVP, Global Communications, Community Impact & Events, (443) 630-9959

Under Armour Unveils Sustainable Design for Teammate Headquarters in Baltimore