UNDER ARMOUR FIRST QUARTER 2020 RESULTS AND EFFORTS TO MANAGE THROUGH IMPACTS OF COVID-19

Under Armour, Inc. (NYSE: UA, UAA) today announced financial results for the first quarter ended March 31, 2020. The company reports its financial performance in accordance with accounting principles generally accepted in the United States of America ("GAAP"). This press release refers to "currency neutral" and "adjusted" amounts, which are non-GAAP financial measures described below under the "Non-GAAP Financial Information" paragraph. References to adjusted financial measures exclude the impact of the company's 2020 restructuring plan and related impairment charges, impairments associated with certain long-lived assets and goodwill and related tax effects. Reconciliations of non-GAAP amounts to the most directly comparable financial measure calculated in accordance with GAAP are presented in supplemental financial information furnished with this release. All per share amounts are reported on a diluted basis.

"As extraordinary human and economic disruptions related to COVID-19 continue to unfold globally, we are prioritizing the health and welfare of our teammates and consumers," said Under Armour President and CEO Patrik Frisk. "By instituting disciplined workplace continuity protocols and adhering to the recommendations of local health authorities, we remain vigilant in monitoring this evolving situation and responsibly playing our part."

"During the first quarter, our results in January and February were tracking well to our plan. Since mid-March, as the pandemic accelerated dramatically in North America and EMEA and retail store closures ensued, we've experienced a significant decline in revenue across all markets." Frisk continued, "As a result, like so many businesses, we've had to make very difficult decisions, including temporarily laying off teammates in our U.S. retail stores and distribution centers along with other actions to ensure we protect Under Armour's financial stability."

Frisk concluded, "As we continue to navigate this crisis, our balance sheet remains well managed, and our leadership team is taking decisive actions to execute against our continued transformation. We remain focused on driving greater efficiencies across the core elements of our business by working to identify additional opportunities to emerge with stronger and greater capabilities over the long-term."

On March 31, our Board of Directors approved the previously announced 2020 restructuring plan, whereby we expect to incur total estimated pre-tax restructuring and related charges in the range of $475 million to $525 million during 2020 including up to approximately $350 million of non-cash charges and $175 million of cash-related restructuring charges.

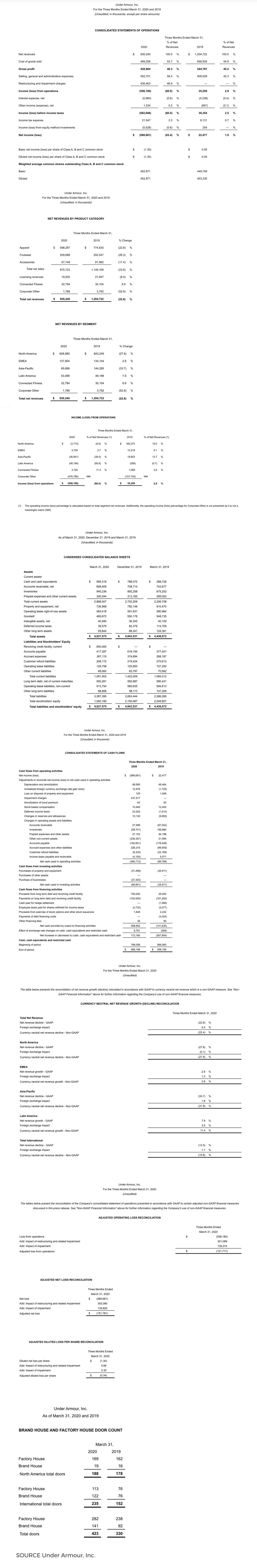

- Revenue was down 23 percent to $930 million (down 22 percent currency neutral) with approximately 15 percentage points of the decline related to COVID-19 pandemic impacts in the quarter.

- Wholesale revenue decreased 28 percent to $592 million and direct-to-consumer revenue was down 14 percent to $284 million, representing 31 percent of total revenue.

- North America revenue decreased 28 percent to $609 million and revenue from our international business decreased 12 percent to $287 million (down 11 percent currency neutral), representing 31 percent of total revenue. Within the international business, revenue increased 3 percent in EMEA (up 4 percent currency neutral), decreased 34 percent in Asia-Pacific (down 32 percent currency neutral), and increased 8 percent in Latin America (up 11 percent currency neutral).

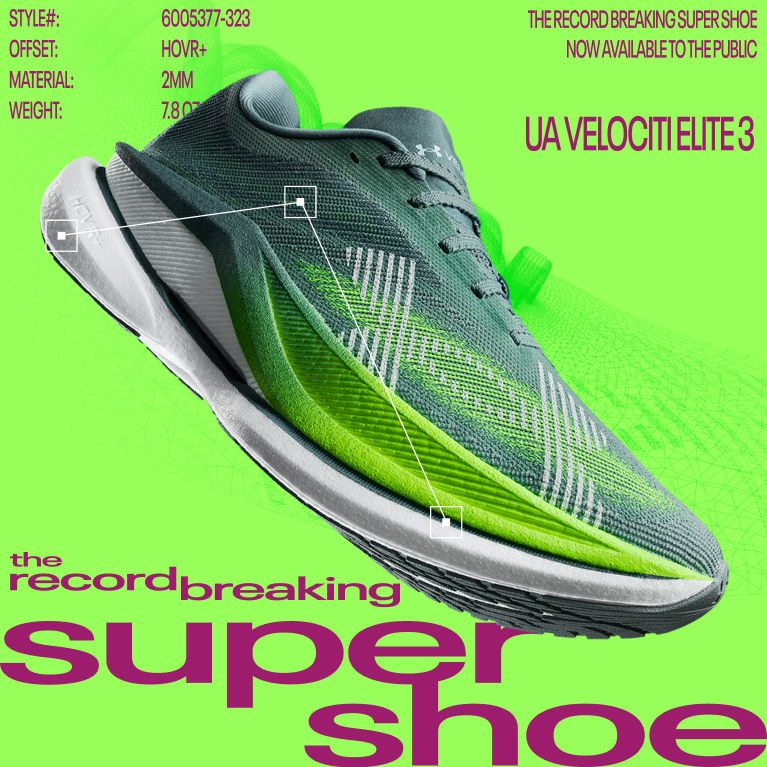

- Apparel revenue decreased 23 percent to $598 million. Footwear revenue decreased 28 percent to $210 million. Accessories revenue decreased 17 percent to $68 million.

- Gross margin increased 110 basis points to 46.3 percent compared to the prior year driven primarily by channel mix which benefitted from lower off-price sales, partially offset by the negative impacts from COVID-19 related discounting and changes in foreign currency.

- Selling, general & administrative expenses increased 8 percent to $553 million driven primarily by increased legal expenses and amplified marketing related activities.

- Restructuring and impairment charges were $436 million consisting of $301 million in restructuring and related impairment charges ($298 million in non-cash and $3 million in cash related charges) and $135 million from impairments of long-lived assets and goodwill.

- Operating loss was $558 million. Excluding the impact of the restructuring plan and impairments, adjusted operating loss was $122 million.

- Net loss was $590 million. Adjusted net loss was $152 million.

- Diluted loss per share was $1.30. Adjusted diluted loss per share was $0.34.

The coronavirus (COVID-19) pandemic has negatively affected the U.S. and global economies, disrupted supply chains and financial markets, and led to significant travel and transportation restrictions, including mandatory closures and orders to "shelter-in-place". Amid this global crisis, Under Armour is focused on protecting the health and safety of our teammates and consumers, while working with our customers and suppliers to minimize potential disruptions and supporting our community to address challenges posed by this pandemic. The following provides an overview and status of certain parts of our business and some of the actions we are taking in response to this situation:

- Business Continuity – as the virus spread rapidly during the first quarter, we began adjusting our operations and taking measures to ensure business continuity, as well as implementing government recommendations to increase social distancing, avoid large gatherings and requiring most office-based teammates around the world to work remotely. Within our supply chain, we quickly adjusted our plans and strategy to manage rapidly changing dynamics in sourcing, logistics and transportation.

- Channel & Business Impacts

- Asia-Pacific: in China, which comprises a little more than half of our revenue in this region, both owned and partner doors began closing in late January and remained substantially closed through early March when a slowly progressive re-opening process started. By the end of March, more than 80 percent of these locations had re-opened in China and, at this time, substantially all have re-opened. However, traffic in these locations, while recovering steadily in recent weeks, continues to be down year-over-year. Business results and trends in South Korea have been similar to those in China, while retail and partner locations outside of these countries in the Asia-Pacific region have remained predominantly closed since the end of the first quarter.

- North America / EMEA / Latin America: beginning mid-March, the company temporarily closed all owned doors across all three of these regions. In addition to these locations, the vast majority of wholesale customer stores where our products are sold also closed down beginning mid-March. At the time of this communication, substantially all of our owned doors and those of our retail partners remain closed. The pace and timing of store openings, and traffic patterns when the stores re-open, remain highly uncertain.

- Global eCommerce: within our owned eCommerce business, which represents a low double-digit percentage of total revenue, we have seen more favorable trends materializing in North America and EMEA since the beginning of the second quarter.

- Financial Impact and Related 2020 Outlook – following the withdrawal of our 2020 outlook on April 3, local market policies and procedures required to decrease COVID-19 transmission remain largely unchanged around the world. Accordingly, due to the high level of uncertainty with respect to the duration and scope of this current event, the quantification of negative impacts on our financial and operating results cannot reasonably be estimated at this time.

- Cost Base Management – we are expecting to reduce our originally planned 2020 operating expenses by approximately $325 million through various initiatives, including:

- Taking actions to limit broader marketing activations until we have greater visibility into the magnitude of virus impact on consumer demand and behavior.

- Reducing incentive compensation.

- Temporarily laying off teammates that worked in our owned retail stores and U.S.-based distribution centers.

- Tightening our hiring, contract services and travel and other discretionary and variable costs.

- Postponing planned capital expenditures contributing to reduced depreciation.

- Realizing the operating expense benefits included within the approximate $40 million to $60 million of expected pre-tax savings in 2020 from our restructuring plan.

- Liquidity and Cash Flow – given ongoing uncertainty and pressures in global markets, we moved quickly to prioritize liquidity, cash preservation, and inventory management to enhance our ability to navigate potential short and mid-term challenges:

- We ended the first quarter with cash and cash equivalents of $959 million, of which approximately $600 million was related to borrowings under our revolving credit facility. We currently have $700 million outstanding under this facility. Additionally, we are in the process of amending our credit agreement, which is on track to close tomorrow. Given the ongoing disruption throughout our industry, we expect this amendment will provide improved access to liquidity going forward.

- We ended the quarter with inventory up 7 percent to $940 million. In anticipation of significant changes in future demand, we are proactively reducing planned inventory receipts amid the quickly evolving retail environment.

- We have been prudently balancing the negotiation of extended payment terms with both our customers and vendors.

- We have reduced our planned capital expenditures to approximately $100 million compared with our previous expectation of approximately $160 million in 2020, with original investments generally expected to continue at such point business conditions stabilize.

Under Armour will hold its first quarter 2020 conference call and webcast today at approximately 8:30 a.m. Eastern Time. The call will be webcast live at https://about.underarmour.com/investor-relations/financials and will be archived and available for replay approximately three hours after the live event.

This press release refers to "currency neutral" and "adjusted" amounts. Currency neutral financial information is calculated to exclude the impact of changes in foreign currency. Currency neutral financial information is calculated to exclude the impact of changes in foreign currency exchange rates. Management believes this information is useful to investors to facilitate a comparison of the company's results of operations period-over-period. Adjusted financial measures exclude the impact of the company's 2020 restructuring plan and related impairment charges, impairments associated with certain long-lived assets and goodwill, and related tax effects. Specifically, in the first quarter of fiscal 2020, we recorded $301 million of restructuring and related impairment charges in connection with our 2020 restructuring plan. Also, we performed an interim long-lived asset impairment and goodwill analysis as of March 31, 2020. In the first quarter of fiscal 2020, we recorded $84 million of impairment charges for long-lived assets primarily related to globally owned retail locations and $51 million of impairment charges related to goodwill allocated to our Latin American as well as our North America reporting segments (due to impacts on our business in Canada). These goodwill charges were as a result of declines in both current and future expected cash flows compared to current net carrying value and were primarily a result of decreased net revenue and cash flow projections worsened by the COVID-19 pandemic, which has resulted in a substantial and prolonged store closures and traffic declines within our global retail store fleet. Management believes this information is useful to investors because it provides enhanced visibility into the company's actual underlying results excluding these impacts. These supplemental non-GAAP financial measures should not be considered in isolation and should be viewed in addition to, and not as an alternative for, the company's reported results prepared in accordance with GAAP. Additionally, the company's non-GAAP financial information may not be comparable to similarly titled measures reported by other companies.

Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer and distributor of branded athletic performance apparel, footwear and accessories. Powered by one of the world's largest digitally connected fitness and wellness communities, Under Armour's innovative products and experiences are designed to help advance human performance, making all athletes better. For further information, please visit https://about.underarmour.com.

Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, the impact of the COVID-19 pandemic on our business, our plans to reduce our 2020 operating expenses, anticipated charges and restructuring costs, the timing of these measures and projected savings related to our restructuring plans, and the potential amendment to our credit agreement, including the timing of the amendment and related impact on our liquidity. In many cases, you can identify forward-looking statements by terms such as "may," "will," "should," "expects," "plans," "assumes," "anticipates," "believes," "estimates," "predicts," "outlook," "potential" or the negative of these terms or other comparable terminology. The forward-looking statements contained in this press release reflect our current views about future events and are subject to risks, uncertainties, assumptions and changes in circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, levels of activity, performance or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by the forward-looking statements, including, but not limited to: the impact of the COVID-19 pandemic on our industry and our business, financial condition and results of operations; changes in general economic or market conditions that could affect overall consumer spending or our industry; changes to the financial health of our customers; loss of key suppliers or manufacturers or failure of our suppliers or manufacturers to produce or deliver our products in a timely or cost-effective manner; our ability to raise capital and financing required to manage our business on terms acceptable to us; our ability to successfully execute our long-term strategies; our ability to successfully execute any potential restructuring plans and realize their expected benefits; our ability to effectively drive operational efficiency in our business; our ability to manage the increasingly complex operations of our global business; our ability to comply with existing trade and other regulations, and the potential impact of new trade, tariff and tax regulations on our profitability; our ability to effectively develop and launch new, innovative and updated products; our ability to accurately forecast consumer demand for our products and manage our inventory in response to changing demands; any disruptions, delays or deficiencies in the design, implementation or application of our new global operating and financial reporting information technology system; increased competition causing us to lose market share or reduce the prices of our products or to increase significantly our marketing efforts; fluctuations in the costs of our products; our ability to further expand our business globally and to drive brand awareness and consumer acceptance of our products in other countries; our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; our ability to successfully manage or realize expected results from acquisitions and other significant investments or capital expenditures; risks related to foreign currency exchange rate fluctuations; our ability to effectively market and maintain a positive brand image; the availability, integration and effective operation of information systems and other technology, as well as any potential interruption of such systems or technology; risks related to data security or privacy breaches; our potential exposure to litigation and other proceedings; and our ability to attract key talent and retain the services of our senior management and key employees. The forward-looking statements contained in this press release reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

Under Armour Contacts:

Lance Allega

SVP, Investor Relations & Corporate Development

(410) 246-6810

View original content: https://www.prnewswire.com/news-releases/under-armour-reports-first-quarter-2020-results-and-highlights-efforts-to-manage-through-impacts-of-covid-19-301056330.html

Q1 2020 Earnings Results Financial Charts